All Categories

Featured

Table of Contents

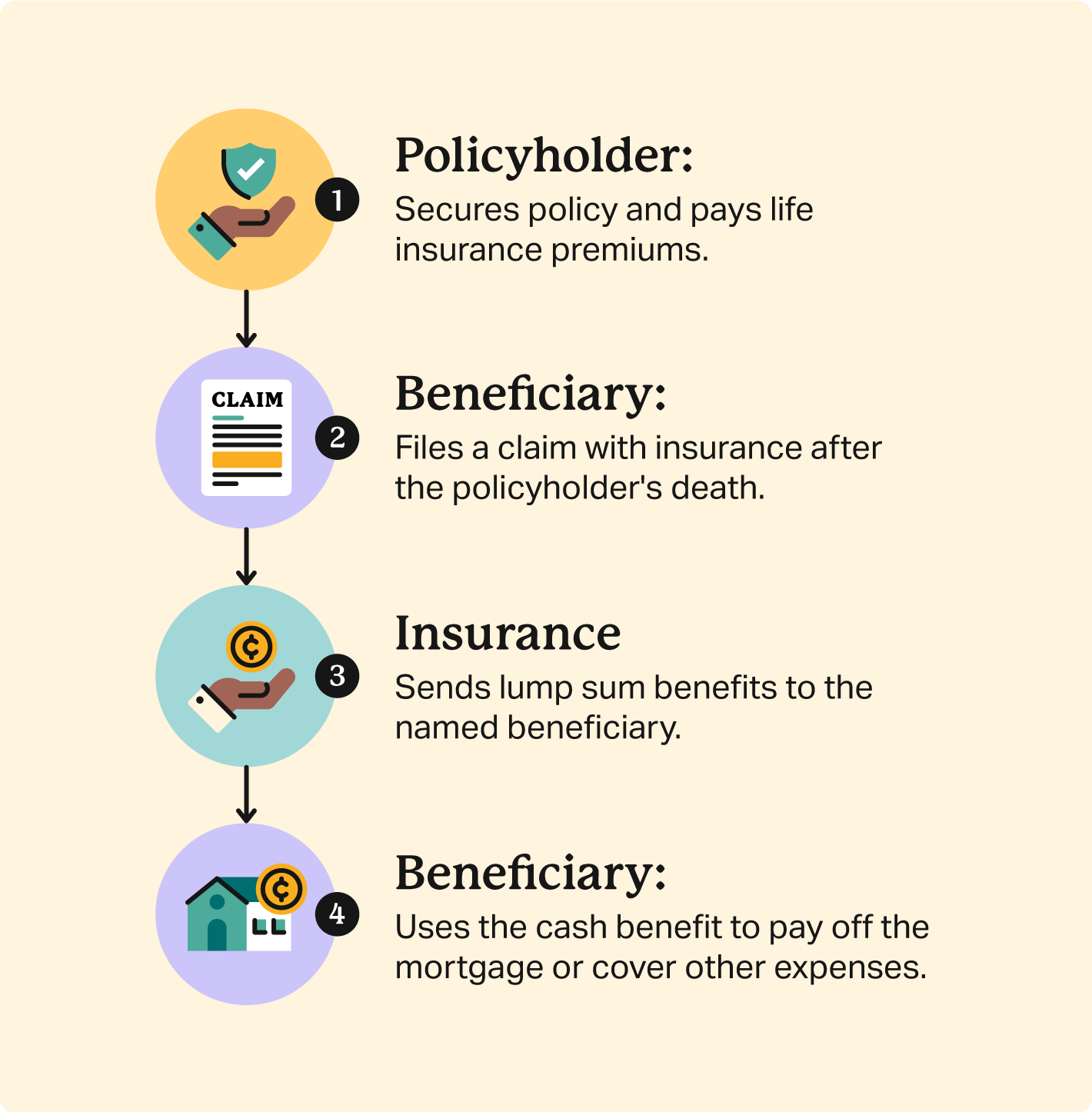

Another opportunity is if the deceased had a current life insurance policy policy. In such situations, the designated beneficiary might get the life insurance earnings and use all or a part of it to pay off the mortgage, allowing them to continue to be in the home. death insurance on a mortgage. For people who have a reverse mortgage, which permits people aged 55 and over to acquire a home mortgage loan based on their home equity, the finance passion accumulates with time

During the residency in the home, no settlements are needed. It is very important for individuals to carefully plan and consider these factors when it comes to home loans in Canada and their influence on the estate and heirs. Seeking advice from lawful and financial experts can help make sure a smooth transition and appropriate handling of the home loan after the homeowner's passing away.

It is important to comprehend the available options to make sure the home loan is properly taken care of. After the death of a home owner, there are a number of alternatives for home mortgage settlement that depend upon numerous variables, including the regards to the home mortgage, the deceased's estate preparation, and the dreams of the beneficiaries. Here are some usual options:: If several beneficiaries wish to think the mortgage, they can become co-borrowers and proceed making the mortgage payments.

This option can provide a tidy resolution to the mortgage and disperse the continuing to be funds among the heirs.: If the deceased had a current life insurance policy policy, the marked recipient might receive the life insurance policy proceeds and use them to pay off the home loan (do mortgages have ppi). This can enable the recipient to continue to be in the home without the worry of the home mortgage

If no person remains to make mortgage settlements after the property owner's death, the home mortgage creditor has the right to foreclose on the home. Nonetheless, the impact of repossession can vary depending on the circumstance. If an heir is named however does not offer your home or make the mortgage payments, the home mortgage servicer could initiate a transfer of possession, and the repossession can drastically harm the non-paying successor's credit.In cases where a property owner passes away without a will or depend on, the courts will assign an administrator of the estate, usually a close living relative, to disperse the assets and liabilities.

Insurance That Pays Off Your Mortgage

Mortgage defense insurance (MPI) is a form of life insurance that is specifically made for individuals who want to make sure their home mortgage is paid if they pass away or end up being disabled. Often this type of plan is called home mortgage repayment defense insurance.

When a bank possesses the huge bulk of your home, they are accountable if something takes place to you and you can no longer pay. PMI covers their danger in the event of a foreclosure on your home (what is mortgage premium insurance). On the other hand, MPI covers your danger in case you can no much longer pay on your home

MPI is the type of home mortgage security insurance every house owner must have in position for their family members. The amount of MPI you need will vary depending on your unique scenario. Some factors you ought to take into consideration when taking into consideration MPI are: Your age Your health and wellness Your economic situation and resources Various other sorts of insurance that you have Some individuals may think that if they presently possess $200,000 on their home loan that they need to purchase a $200,000 MPI plan.

Mortgage Insurance Association

The brief answer isit depends. The concerns individuals have about whether or not MPI is worth it or not are the same inquiries they have about buying other type of insurance coverage generally. For many people, a home is our single biggest debt. That suggests it's mosting likely to be the solitary largest economic difficulty facing making it through household members when an income producer dies.

The combination of anxiety, sadness and altering household characteristics can create also the most effective intentioned individuals to make expensive mistakes. loan protection insurance uk. MPI addresses that problem. The value of the MPI policy is straight tied to the equilibrium of your home loan, and insurance policy profits are paid directly to the financial institution to take care of the remaining balance

And the largest and most demanding economic issue dealing with the making it through member of the family is solved promptly. If you have health concerns that have or will develop troubles for you being accepted for normal life insurance coverage, such as term or whole life, MPI can be an exceptional option for you. Normally, mortgage protection insurance plan do not require medical examinations.

Historically, the quantity of insurance protection on MPI policies dropped as the balance on a home mortgage was decreased. Today, the protection on most MPI plans will stay at the same degree you purchased at first. If your original mortgage was $150,000 and you purchased $150,000 of home loan security life insurance, your beneficiaries will certainly now obtain $150,000 no issue how much you owe on your mortgage.

If you wish to pay off your home loan early, some insurance companies will allow you to transform your MPI plan to an additional sort of life insurance policy. This is one of the questions you may wish to attend to up front if you are taking into consideration repaying your home early. Prices for mortgage protection insurance coverage will vary based upon a number of things.

Mortgage Life Insurance And Critical Illness Cover

An additional aspect that will certainly influence the costs quantity is if you acquire an MPI policy that offers protection for both you and your spouse, supplying advantages when either one of you passes away or comes to be disabled. Be aware that some companies might require your policy to be editioned if you refinance your home, however that's generally just the situation if you acquired a policy that pays only the equilibrium left on your mortgage.

What it covers is extremely narrow and clearly specified, depending on the alternatives you choose for your specific policy. If you die, your home mortgage is paid off.

For mortgage defense insurance policy, these kinds of added protection are included on to plans and are known as living benefit motorcyclists. They allow plan owners to tap into their mortgage defense advantages without passing away.

For instances of, this is normally currently a cost-free living advantage offered by the majority of firms, however each company specifies advantage payouts in a different way. This covers health problems such as cancer, kidney failure, cardiac arrest, strokes, mind damage and others. selling mortgage protection. Companies usually pay out in a lump sum depending on the insured's age and extent of the illness

Sometimes, if you use 100% of the permitted funds, after that you utilized 100% of the policy survivor benefit value. Unlike many life insurance plans, buying MPI does not call for a medical examination much of the moment. It is marketed without underwriting. This indicates if you can not obtain term life insurance coverage due to a health problem, an assured problem mortgage defense insurance plan might be your finest wager.

Preferably, these ought to be people you recognize and trust that will give you the most effective advice for your situation. Despite that you choose to explore a policy with, you should constantly search, since you do have alternatives - insurance to cover loan. Often, unintentional fatality insurance is a far better fit. If you do not receive term life insurance policy, after that unexpected death insurance policy might make more feeling due to the fact that it's warranty issue and means you will certainly not be subject to medical exams or underwriting.

Protection For Mortgage

Ensure it covers all costs connected to your mortgage, including rate of interest and settlements. Take into consideration these elements when deciding precisely just how much coverage you assume you will certainly need. Ask how swiftly the plan will be paid if and when the primary earnings earner dies. Your family will be under sufficient emotional anxiety without needing to ask yourself the length of time it might be prior to you see a payout.

Latest Posts

Final Expense Insurance Delaware

Benefits Of Final Expense Insurance

Funeral Protection