All Categories

Featured

Table of Contents

Another possibility is if the deceased had an existing life insurance policy policy. In such instances, the assigned recipient may obtain the life insurance policy earnings and use all or a part of it to settle the home mortgage, allowing them to remain in the home. foreclosure and mortgage insurance. For individuals that have a reverse mortgage, which allows individuals aged 55 and over to acquire a mortgage based on their home equity, the funding interest accrues with time

During the residency in the home, no repayments are called for. It is very important for people to carefully plan and take into consideration these variables when it comes to home loans in Canada and their effect on the estate and beneficiaries. Seeking assistance from legal and financial professionals can assist make sure a smooth shift and correct handling of the mortgage after the home owner's death.

It is essential to understand the available options to make certain the home mortgage is properly handled. After the fatality of a house owner, there are a number of options for home mortgage settlement that depend upon various variables, consisting of the terms of the mortgage, the deceased's estate preparation, and the wishes of the successors. Here are some common choices:: If several beneficiaries wish to think the home mortgage, they can become co-borrowers and continue making the home loan repayments.

This option can provide a tidy resolution to the home loan and distribute the staying funds amongst the heirs.: If the deceased had a current life insurance policy plan, the assigned recipient may get the life insurance policy earnings and use them to pay off the home loan (is mortgage insurance required by law). This can allow the recipient to stay in the home without the worry of the home loan

If no one proceeds to make home loan payments after the home owner's death, the home mortgage financial institution can confiscate on the home. The influence of repossession can vary depending on the circumstance. If an heir is called but does not market the house or make the home mortgage payments, the home mortgage servicer might launch a transfer of ownership, and the foreclosure can seriously harm the non-paying beneficiary's credit.In situations where a homeowner dies without a will or count on, the courts will select an executor of the estate, generally a close living relative, to distribute the properties and liabilities.

Mortgage Credit Protection

Home mortgage protection insurance policy (MPI) is a form of life insurance policy that is especially created for people that intend to make certain their home mortgage is paid if they pass away or become impaired. Sometimes this sort of plan is called home loan repayment security insurance coverage. The MPI procedure is straightforward. When you die, the insurance proceeds are paid directly to your home loan firm.

When a bank possesses the large bulk of your home, they are liable if something takes place to you and you can no longer make repayments. PMI covers their risk in case of a foreclosure on your home (mortgage insurance services). On the other hand, MPI covers your risk in case you can no longer make payments on your home

MPI is the sort of home mortgage security insurance coverage every property owner need to have in position for their household. The amount of MPI you require will certainly differ depending on your special scenario. Some factors you need to think about when taking into consideration MPI are: Your age Your wellness Your financial circumstance and sources Other sorts of insurance that you have Some people may think that if they currently have $200,000 on their home mortgage that they must get a $200,000 MPI policy.

Best Term Insurance For Home Loan

The inquiries individuals have about whether or not MPI is worth it or not are the very same questions they have regarding purchasing other kinds of insurance policy in general. For most individuals, a home is our solitary biggest financial obligation.

The combination of tension, grief and changing family characteristics can trigger also the best intentioned individuals to make pricey blunders. mortgage cover for death. MPI resolves that problem. The worth of the MPI policy is straight linked to the balance of your home mortgage, and insurance coverage earnings are paid straight to the bank to look after the continuing to be equilibrium

And the largest and most difficult economic problem dealing with the surviving household members is dealt with promptly. If you have wellness problems that have or will develop troubles for you being accepted for regular life insurance coverage, such as term or whole life, MPI could be an exceptional alternative for you. Typically, mortgage defense insurance plan do not need medical exams.

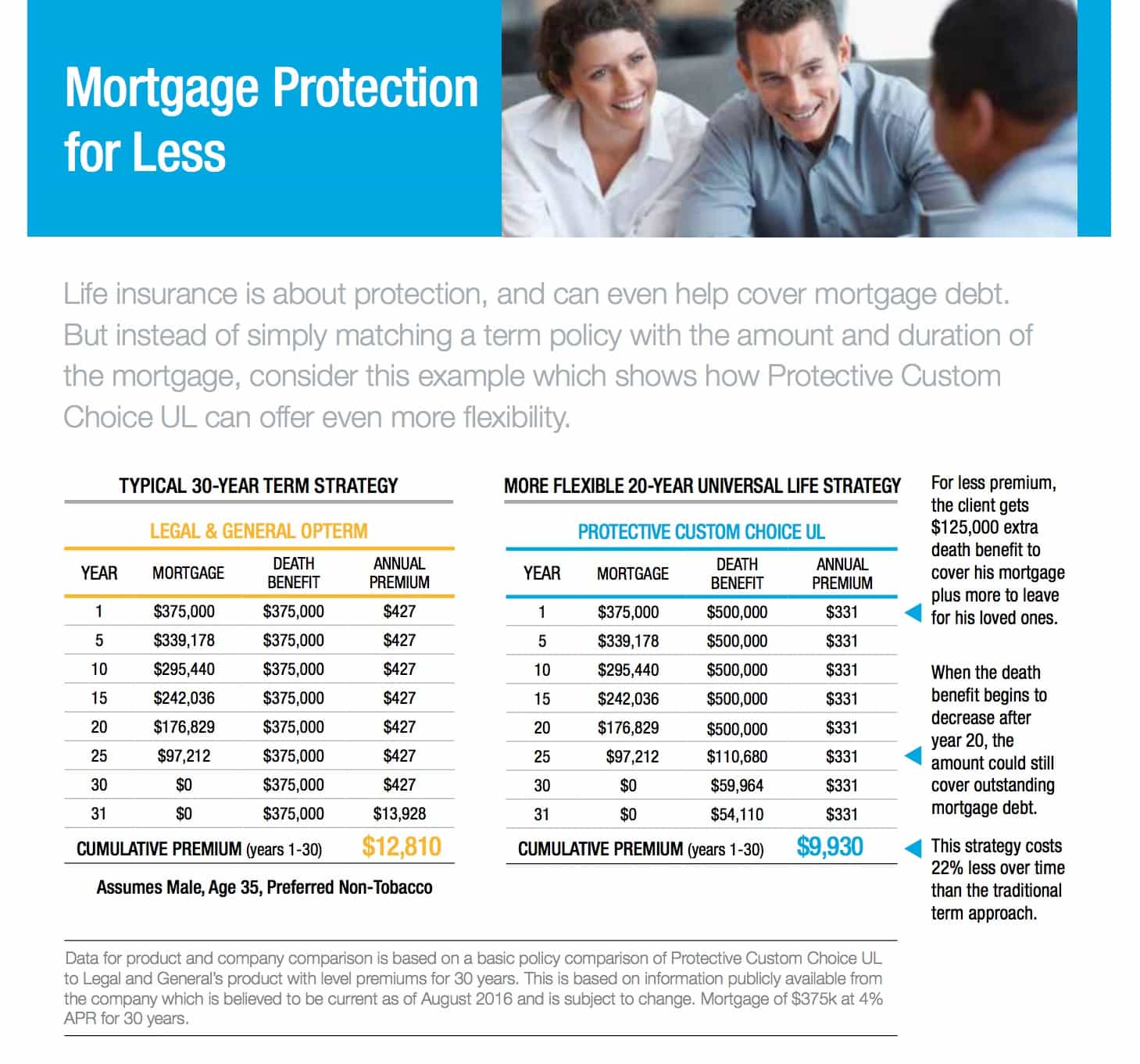

Historically, the amount of insurance policy protection on MPI plans went down as the balance on a mortgage was lowered. Today, the insurance coverage on a lot of MPI policies will certainly stay at the same degree you acquired. As an example, if your initial mortgage was $150,000 and you purchased $150,000 of home loan protection life insurance, your recipients will certainly currently obtain $150,000 regardless of just how much you owe on your mortgage - home loan with insurance cover.

If you intend to settle your home loan early, some insurance provider will allow you to convert your MPI plan to an additional type of life insurance policy. This is among the concerns you may desire to deal with in advance if you are taking into consideration repaying your home early. Prices for home mortgage security insurance coverage will vary based on a variety of things.

Loan Protection Insurance Cost

One more aspect that will influence the costs quantity is if you acquire an MPI policy that offers protection for both you and your partner, supplying benefits when either one of you passes away or becomes handicapped. Be conscious that some companies may require your policy to be reissued if you refinance your home, however that's generally just the case if you purchased a policy that pays out just the equilibrium left on your home loan.

What it covers is really narrow and plainly specified, depending on the choices you choose for your certain plan. If you pass away, your home loan is paid off.

For mortgage protection insurance policy, these forms of added insurance coverage are added to plans and are referred to as living benefit motorcyclists. They enable policy holders to touch right into their mortgage security advantages without diing. Right here's exactly how living benefit bikers can make a mortgage protection plan much more important. In situations of, most insurance provider have this as a free advantage.

For situations of, this is usually currently a totally free living benefit offered by many companies, but each firm specifies advantage payments in a different way. This covers diseases such as cancer, kidney failure, heart assaults, strokes, mental retardation and others. life insurance against mortgage. Firms normally pay in a lump amount depending upon the insured's age and intensity of the health problem

In some instances, if you utilize 100% of the allowed funds, then you used 100% of the policy death advantage worth. Unlike a lot of life insurance plans, acquiring MPI does not require a clinical examination much of the moment. It is sold without underwriting. This suggests if you can not obtain term life insurance policy as a result of a disease, an ensured problem home loan defense insurance coverage policy could be your best option.

No matter of who you decide to discover a policy with, you ought to constantly shop about, due to the fact that you do have choices. If you do not certify for term life insurance policy, then unintended death insurance policy may make even more feeling due to the fact that it's warranty problem and indicates you will certainly not be subject to clinical examinations or underwriting.

Mortgage Payment Protection Cover

Make certain it covers all expenses connected to your mortgage, consisting of interest and settlements. Ask just how promptly the policy will be paid out if and when the main revenue earner passes away.

Latest Posts

Final Expense Insurance Delaware

Benefits Of Final Expense Insurance

Funeral Protection