All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (final expense life insurance brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

They normally give an amount of coverage for much less than long-term kinds of life insurance. Like any kind of plan, term life insurance policy has advantages and disadvantages depending upon what will work best for you. The benefits of term life consist of affordability and the ability to customize your term size and insurance coverage quantity based upon your needs.

Depending on the type of plan, term life can offer set costs for the whole term or life insurance on level terms. The fatality advantages can be repaired.

Cost-Effective The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

You need to consult your tax experts for your particular factual situation. Rates mirror plans in the Preferred Plus Rate Class problems by American General 5 Stars My representative was very experienced and valuable at the same time. No stress to purchase and the process fasted. July 13, 2023 5 Stars I was satisfied that all my needs were satisfied without delay and professionally by all the agents I talked to.

All paperwork was digitally completed with access to downloading and install for individual documents upkeep. June 19, 2023 The endorsements/testimonials provided should not be interpreted as a referral to acquire, or a sign of the value of any type of product and services. The reviews are real Corebridge Direct consumers that are not associated with Corebridge Direct and were not provided payment.

2 Expense of insurance prices are determined utilizing methods that differ by business. It's important to look at all factors when evaluating the overall competition of rates and the value of life insurance coverage.

A Renewable Term Life Insurance Policy Can Be Renewed

Nothing in these materials is meant to be suggestions for a certain situation or individual. Please seek advice from your own experts for such advice. Like many group insurance plan, insurance plan provided by MetLife have certain exclusions, exceptions, waiting periods, reductions, restrictions and terms for maintaining them effective. Please call your advantages administrator or MetLife for prices and full information.

For the most component, there are two sorts of life insurance coverage plans - either term or long-term strategies or some mix of both. Life insurance providers supply numerous types of term strategies and traditional life policies along with "passion delicate" items which have actually ended up being extra widespread because the 1980's.

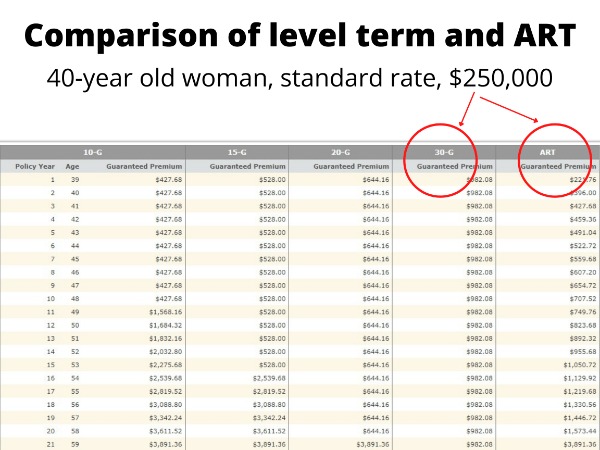

Term insurance policy gives defense for a specified amount of time. This duration might be as brief as one year or provide protection for a certain variety of years such as 5, 10, 20 years or to a specified age such as 80 or in many cases up to the oldest age in the life insurance policy death tables.

Outstanding Level Term Life Insurance Meaning

Presently term insurance policy prices are really competitive and amongst the most affordable historically skilled. It needs to be noted that it is a widely held idea that term insurance is the least pricey pure life insurance coverage readily available. One needs to review the plan terms thoroughly to determine which term life options appropriate to fulfill your particular scenarios.

With each brand-new term the costs is raised. The right to restore the policy without evidence of insurability is a vital advantage to you. Otherwise, the threat you take is that your health may deteriorate and you might be incapable to get a plan at the very same rates or perhaps at all, leaving you and your recipients without insurance coverage.

You need to exercise this choice during the conversion duration. The length of the conversion duration will certainly vary depending on the sort of term plan acquired. If you transform within the proposed period, you are not needed to offer any type of information regarding your health and wellness. The costs rate you pay on conversion is usually based on your "present acquired age", which is your age on the conversion date.

Under a degree term policy the face quantity of the policy stays the exact same for the entire duration. With reducing term the face amount lowers over the duration. The costs remains the exact same each year. Commonly such plans are marketed as home mortgage defense with the quantity of insurance decreasing as the balance of the home mortgage lowers.

Typically, insurance companies have not deserved to change costs after the policy is offered (a whole life policy option where extended term insurance is selected is called). Given that such policies may continue for years, insurance firms need to make use of conservative mortality, rate of interest and expense price price quotes in the premium calculation. Flexible costs insurance, nonetheless, allows insurance firms to use insurance at reduced "existing" premiums based upon less conventional assumptions with the right to transform these costs in the future

Leading Level Term Life Insurance

While term insurance policy is developed to supply security for a defined time period, long-term insurance coverage is created to give coverage for your whole lifetime. To maintain the costs price level, the costs at the younger ages surpasses the actual cost of defense. This additional costs constructs a book (money worth) which helps pay for the policy in later years as the price of defense rises over the costs.

The insurance policy business invests the excess costs dollars This type of policy, which is in some cases called money value life insurance policy, creates a savings component. Money values are vital to a long-term life insurance coverage plan.

Honest Group Term Life Insurance Tax

Occasionally, there is no relationship in between the size of the cash money value and the premiums paid. It is the money value of the plan that can be accessed while the insurance policy holder lives. The Commissioners 1980 Requirement Ordinary Mortality Table (CSO) is the present table made use of in computing minimal nonforfeiture worths and plan books for ordinary life insurance policy plans.

There are 2 standard groups of permanent insurance policy, standard and interest-sensitive, each with a number of variations. Typical entire life plans are based upon long-term price quotes of cost, interest and death (level term life insurance meaning).

If these estimates transform in later years, the company will certainly adjust the premium accordingly however never ever over the maximum assured costs mentioned in the policy. An economatic entire life policy offers a standard quantity of participating entire life insurance policy with an additional supplementary insurance coverage given through the use of returns.

Because the costs are paid over a much shorter period of time, the costs settlements will certainly be greater than under the entire life plan. Solitary costs whole life is minimal repayment life where one huge exceptional payment is made. The policy is completely compensated and no more premiums are called for.

Latest Posts

Final Expense Insurance Delaware

Benefits Of Final Expense Insurance

Funeral Protection